Allocate Overhead Cost Formula

Overhead allocation rate Total overhead Total labor hours. Heres how that would look if Company A had 700 labor hours per month.

Traditional Methods Of Allocating Manufacturing Overhead Accountingcoach

Total overhead total labor hours overhead allocation rate.

. There are two types of rates. 6 to 30 characters long. Determining how much of each of these components to allocate to particular goods requires either tracking the particular costs or making.

We have a 100000 unit with a 30 residual that we have to allocate over a five-year holding period. Here the labor hours will be base units. Rates are defined per cost object and cost element.

You can use a change order to enter quote information for a project. 500150 40 cents or 500110 456 units This means that you need to sell at least 456 units just to cover your costs. T is a measure used to allocate unallocated overhead costs to products manufactured for better cost planning and monitoring.

ASCII characters only characters found on a standard US keyboard. This gives units different weights based on their cost or value. Fiscal period and user-specified.

You paid 10000 to get a lease with 20 years remaining on it and two options to renew for 5 years each. Therefore detailed managerial insight isnt provided for Cost accounting. Manufacturing Overheads 310000 300000 310000.

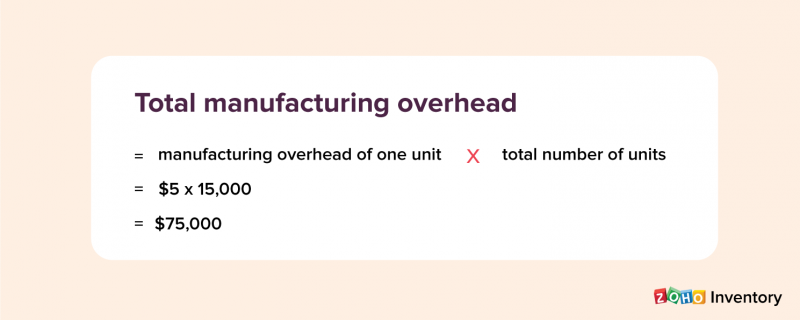

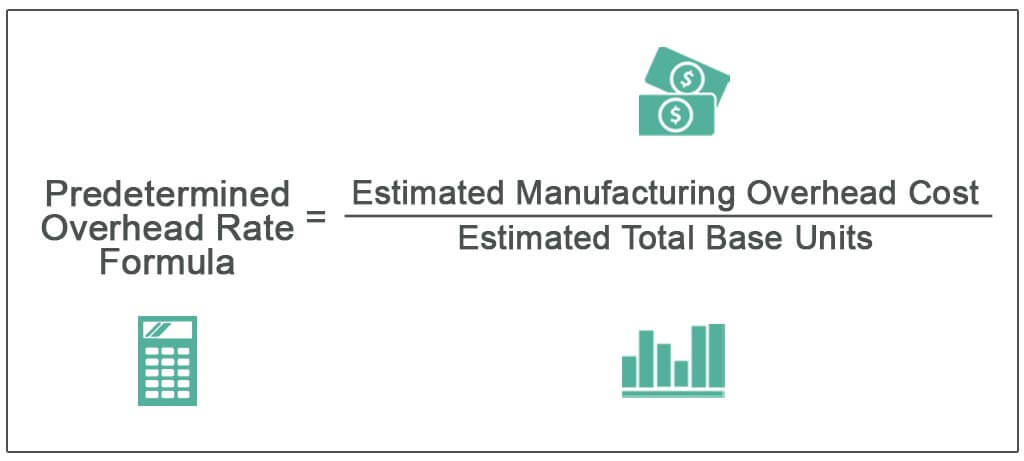

Cost pool Total activity measure Overhead allocation per unit. The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value. You are required to compute a predetermined overhead rate.

Thus the overhead allocation formula is. Apply the overhead by multiplying the overhead allocation rate by the number of direct labor hours needed to make each product. The phrase contribution margin can also refer to a per unit measure.

The simplest way of doing this is by allocating a fixed percentage to each unit eG 1 Of joint costs per unit. Conversion Cost 610000. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

This approach is an excellent tool for tracing specific costs to individual jobs and examining them to see if the costs can be reduced in later jobs. More sophisticated methods allocate different proportions of. Of this cost you paid 7000 for the original lease and 3000 for the renewal options.

Conversion Cost per Unit 610. Here we learn how to calculate total standard cost using its formula along with examples and downloadable excel template. Calculate and allocate the Electricity overhead cost.

It is calculated by dividing the average number of. A company usually uses a single cost allocation basis such as labor hours or machine hours to allocate costs from cost pools to designated cost objects. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The total cost for the cost category will be calculated using the following formula. That means allocating 70000 over five years or. Must contain at least 4 different symbols.

The absorption rate is the rate at which available homes are sold in a specific real estate market during a given time period. Identify your chosen cost object. Job costing involves the accumulation of the costs of materials labor and overhead for a specific job.

A cost pool is a grouping of individual costs from which cost allocations are made later. This means that for every hour spent consulting Company A needs to allocate 17142 in overhead. Use a change order to enter quote information for a project.

Overhead cost maintenance cost and other fixed costs are typical examples of cost pools. Cost of goods sold COGS is the. Fiscal period rates are calculated by the overhead calculation.

Get 247 customer support help when you place a homework help service order with us. An alternative use is to see if any excess costs incurred can be billed to a customer. Common bases of allocation are direct labor hours charged against a product or the amount of machine hours used.

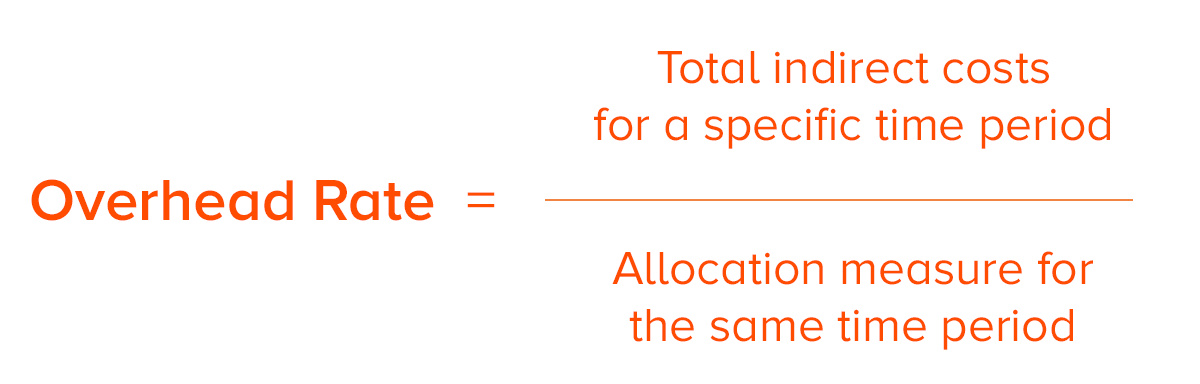

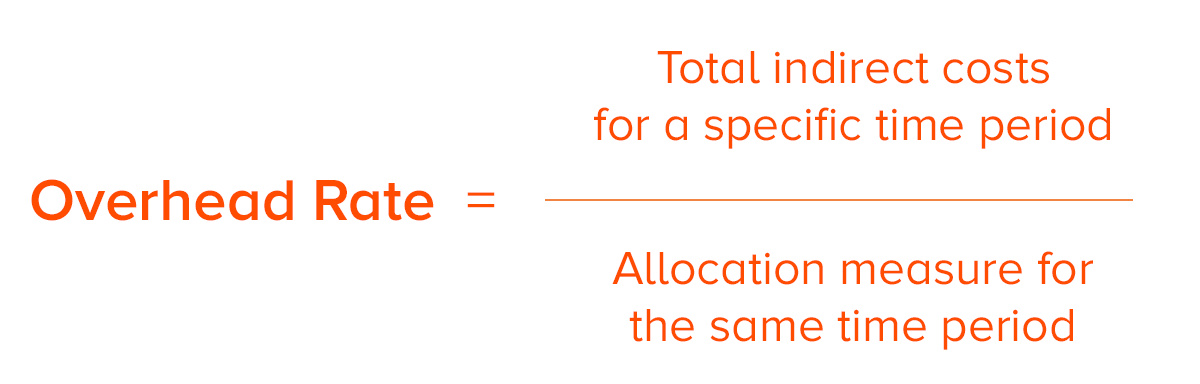

The estimated manufacturing overhead was 155000 and the estimated labor hours involved were 1200 hours. Applied Overhead Formula Estimated Amount of Overhead Costs Estimated Activity of the Base Unit. Overhead is an accounting term that refers to all ongoing business expenses not including or related to direct labor direct materials or third-party expenses that are billed directly to customers.

Using the number of units produced as the allocation method we can calculate overhead costs using the formula. A user-specific rate is user-defined and can be used to allocate cost between cost objects at a predetermined rate in the overhead calculation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Including applied overhead cost it helps in managerial decision making ie pricing decisions if it can go with the production of a particular product. To allocate costs begin by deciding which cost objects you want to connect with specific costs. The formula is as follows.

If you can sell more than 456 units your first month. Get 247 customer support help when you place a homework help service order with us. Open the Change Order Budget Information window.

Total cost Quantity amount x Unit Cost amount overhead. To the goods many producers allocate the standard or the expected cost. Suppose that X limited produces a product X and uses labor hours to assign the manufacturing overhead cost.

Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. A Formula for Equipment Cost Recovery. Cost object Formula Magnitude Allocation factor Amount.

Calculation of Fixed Overhead Cost you can do using below formula as Fixed Overhead Cost SH FSR 388800750 29160. In Financial accounting some costs such as electricity are registered as a lump sum. This means for every hour needed to make a product you need to allocate 333 worth of overhead to that product.

Because 7000 is less than 75 of the total 10000 cost of the lease or 7500 you must amortize the 10000 over 30 years. Examples include specific products marketing campaigns or business departments and divisions. One can know better which expenses to allocate to overheads.

Labor and allocated overhead. You can allocate overhead costs by any reasonable measure as long as it is consistently applied across reporting periods.

Applied Overhead Predetermined Rate Double Entry Bookkeeping

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

0 Response to "Allocate Overhead Cost Formula"

Post a Comment